MMS Mortgage Services, Ltd. Frequently Asked Questions

Q: What is the interest rate?

The only way we can tell you the interest rate you would qualify for is for you to apply. Your credit score, debt-to-income ratio, and other factors all can have an influence on the final rates you receive.

World events also impact the financial markets which drive mortgage loan interest rates, timing is everything when determining your interest rate.

Q: What is the loan term?

Different mortgage products have different loan terms available. We can help you identify a product that will fit your needs during your consultation.

Q: What are your mortgage fees?

The exact fees associated with your mortgage will depend on the specifics involved in your scenario. At your consultation, we can provide you with in individual estimate.

Q: Who is going to service the loan?

We cannot service government loans, but we are able to service the majority of other loans.

Q: What is the minimum credit score?

The credit score you need to qualify for a mortgage varies depending on what type of mortgage you apply for.

We offer mortgage products that feature flexible requirements with respect to credit scores.

Q: How much can I borrow?

How much you qualify to borrow is determined by your individual qualifications, the type of home loan for which you are applying, and limits for that type of loan.

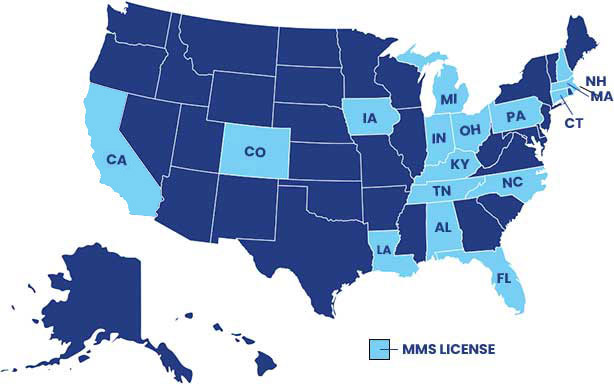

Q: Do you work with clients in my state?

MMS is based in Michigan and works with borrowers throughout that state. We are also licensed in Alabama, Colorado, Connecticut, Florida, Indiana, Iowa, Kentucky, Louisiana, Massachusetts, Michigan, New Hampshire, North Carolina, Ohio, Pennsylvania and Tennessee.

Apply Now

If you are shopping for a home in any of those states, we can assist you. To get started, please call (248) 788-0800 or toll free at (800) 945-4506 then press 2, to schedule your free consultation.

See What Our Clients Are Saying About Us

Quick Links

Contact

- MMS Mortgage Services, Ltd.

38275 W 12 Mile Rd #100

Farmington Hills, MI 48331 - (248) 788-0800

- (800) 945-4506 (Toll Free)

- Find us on Google

- NMLS ID: 131062

Underwriting Approved Certificate This new program is the highest level of approval a buyer/borrower can obtain without yet choosing a property. Our experienced Loan Officer will open a loan file, assign a loan number, take the application, gather the buyers’ income documents, bank/investment statements and credit report, submit the file for automated underwriting and have a live underwriter approve the loan subject to title and appraisal if required at all.

You cannot get more approved than “Underwriting Approved!” This lets the Seller’s Agent/Broker know the buyer is the real deal and is “Underwriting Approved.”

Copyright © MMS Mortgage Services, Ltd. All Rights Reserved.

Terms of Use | Privacy Policy | TCPA Consent | Company Directory | Career Opportunities | State Licensing

MMS Mortgage Services, Ltd. is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age, because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. Disclaimer: Programs subject to change without notice. All borrowers must qualify per program guidelines. This material has not been reviewed, approved or issued by HUD, FHA or any government agency. MMS Mortgage Services, Ltd. is not affiliated with or acting on behalf of or at the direction of HUD/FHA or any other government agency.